Defining DSP: A Brief History of the Evolution of AdTech

A demand-side platform, or DSP, is a powerful media buying platform that allows advertisers and marketers to purchase highly targeted digital ad space efficiently and at scale. DSPs remedy the inefficiencies traditionally associated with purchasing ad space across hundreds or thousands of individual publishers by aggregating available inventory in one central platform. Billing, RFPs, and performance reporting can also be handled from one central user interface (UI).

DSPs such as Google Marketing Platform’s Display & Video 360 (DV360) brings tremendous transparency, reach, and control to advertisers, but seasoned marketers surely remember a time when this wasn’t the case. Let’s explore the evolution of adtech from one-to-one direct reservation deals to the advent of modern DSPs.

The First Banner Ads Revolutionized Media Buying

While the precise genesis of “banner” ads on the web is somewhat murky, it’s generally agreed upon that banner ads got their start sometime in 1993-1994. Whether or not they were truly “first,” AT&T often gets credit for placing this banner (seen below) on hotwired.com.

AT&T reportedly paid somewhere in the neighborhood of $30,000 for a 3-month placement on the site, which allegedly boasted a clickthrough rate of 44 percent! (No, I’m not missing a decimal).

Depending on where you look, what article you read, or who you ask, you might also see Silicon Valley law firm Heller, Ehrman, White and McAuliffe being credited with the placement of a banner ad on internet pioneer Tim O’Reilly’s Global Network Navigator (GNN). GNN went on to be acquired by AOL in 1995.

Regardless of who was actually first, the point is that these early ad buys were negotiated and transacted in direct, one-off, one-to-one deals between advertiser and publisher.

This new medium for advertising was revolutionary, but at the time, the internet was experiencing explosive growth, and this method of striking deals was difficult to scale. Managing hundreds of deals across hundreds of individual publishers quickly became highly burdensome from an administrative standpoint. It also left publishers with the problem of figuring out what to do with ad inventory that was left unsold.

Ad Networks Introduce Scalability, Lack Transparency

Enter the Ad Network. Ad networks, like AdRoll, Outbrain, and Taboola, are companies that essentially act as middlemen between hundreds of individual publishers (selling ad space) and advertisers (buying ad space). An ad network helps match buyers and sellers by aggregating unsold ad inventory across publishers in the ad network, packaging it, and reselling it in bulk to advertisers. This leftover or “remnant” inventory is sold to the network at a discount compared to inventory that was sold via a direct deal, often leading to large margins for the ad networks.

The first ad networks began appearing around 1997, and again, were a revolutionary technology. The rapid rate at which the internet was growing quickly spawned new issues that ad buyers and sellers had to deal with.

Everyone wanted a piece of the action and barriers to entry were relatively low, eventually leading to hundreds of competing ad networks. Ad networks, once created to act as a central media buying hub, soon morphed into hundreds of distinct, yet oftentimes overlapping, networks scattered across various parts of the web.

When transacting via direct, one-to-one ad buys, it is clear where an ad will be served — on the publisher site with whom you negotiated and struck a deal. Because ad networks package and sell remnant inventory from many publishers in aggregation, lack of transparency and a fair method of pricing ads eventually became an issue. This “bulk sale” model made it difficult to identify on which publisher sites ads were being served, what the ad format was, and how the ad was priced compared to other advertisers vying for the same placement.

Ad Exchanges Provide Transparency & Competition

Ad Exchanges bring increased transparency, control, and competition to the ad buying industry. While ad networks are companies that package, markup, and resell ad inventory, ad exchanges are a technology that acts as a buyer-seller marketplace for the mass sale of individual impressions.

Ad exchanges, like Google Ad Exchange, Rubicon, and AppNexus, operate on an auction model. Every time an ad impression becomes available for sale on a publisher site, a micro-auction occurs. Billions of these micro-auctions happen every day. Sometimes ad networks bid on impressions on ad exchanges.

When an auction occurs, the publisher will send detailed information about itself and the anonymized user to the exchange. The exchange then cross-references the information provided by the publisher with specific targeting and bidding information provided by thousands of different advertisers to select the most optimal ad to fill the available placement.

Demand-Side Platforms to Execute Ad Buys

Now back to why we’re here. A demand-side platform, or DSP, works in tandem with ad exchanges. A DSP is the platform that allows marketers and advertisers to programmatically bid on and execute ad buys on ad exchanges with vast reach and highly specific targeting and bidding parameters, from one central platform.

When ad space becomes available for sale, an exchange will send a bid request to advertisers. Billions of bid requests are sent to advertisers every day, and the DSP determines how to handle every individual bid request.

Without a DSP or other similar software, it would be nearly impossible to field billions of bid requests every day.

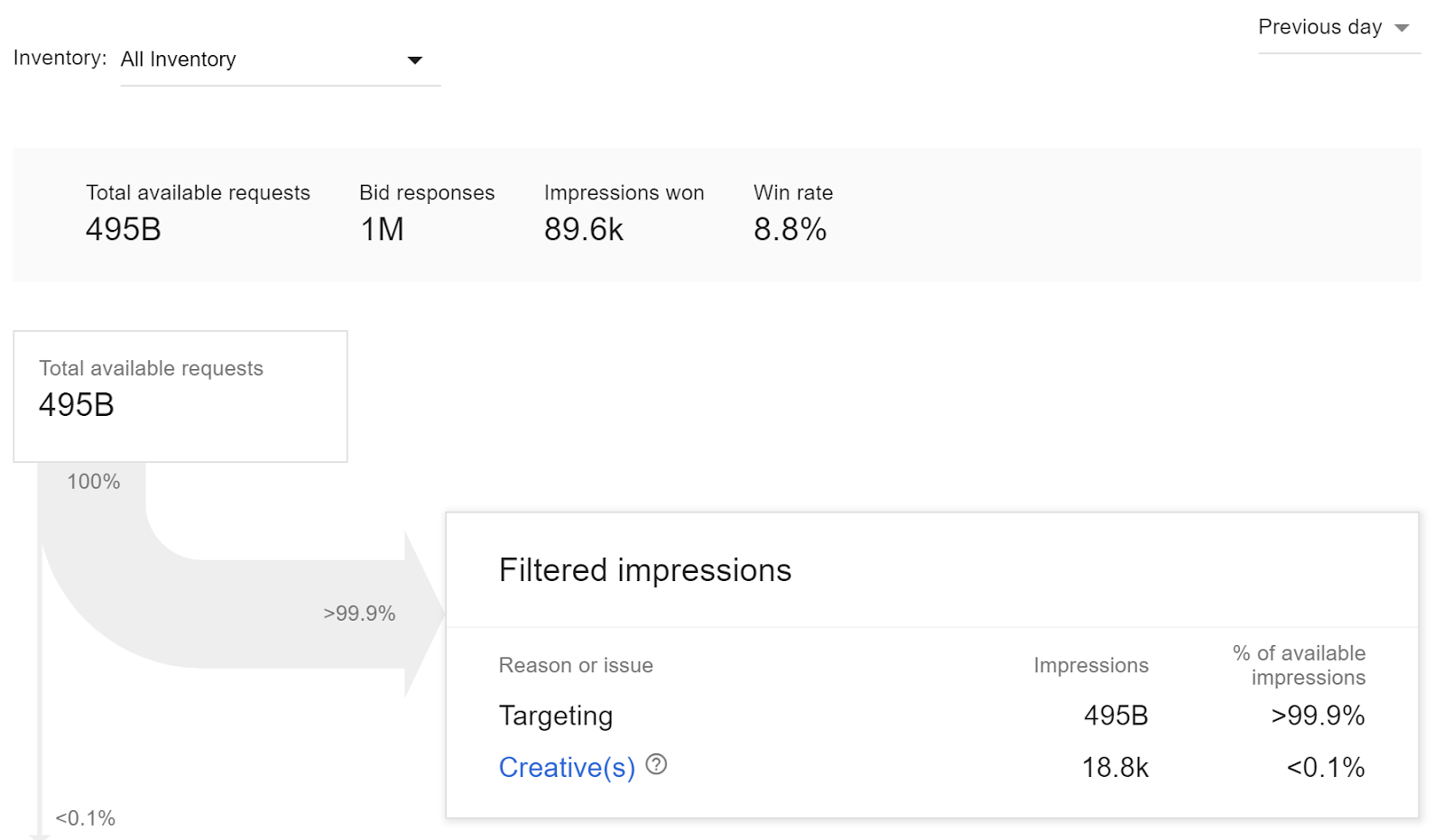

In just a single day, an advertiser may receive nearly 1 trillion bid requests. Within a matter of milliseconds, a DSP must determine whether or not to respond to the bid request, and if so, how much to bid and what ad creative to serve.

For example, one of my advertisers received almost 495 billion requests, and less than 0.1 percent of those requests were met with a response, with the vast majority being filtered out due to not meeting targeting criteria.

DSPs provide a user-facing interface for an advertiser to set targeting criteria and settings such as geolocation, device type, audience segment, ad scheduling, and frequency capping, which then determines how the DSP handles bid requests in real-time, on an impression-by-impression basis.

If being compared to a car, it could be appropriate to think of the ad exchange as the engine, and the DSP as the internal controls that guide the car. Similar to how a car needs a gas pedal, brakes, and a steering wheel to effectively utilize the power of the engine, as well as seatbelts, navigation, and climate control to ensure a safe, effective and comfortable ride—an advertiser needs a DSP to control things like bidding, spend pacing, ad scheduling, brand safety, and other targeting across the V8 twin-turbo engine that is an ad exchange.

DSPs are Evolving

Today’s media buyers now expect more — technology integration, broad reach, precise control, highly premium inventory, efficient workflows, and accurate measurement. DSPs like Adobe Advertising Cloud DSP, The Trade Desk, Centro, MediaMath, and Google’s DV360 have evolved to meet the demand of savvy buyers. As long-time partners of Google, we’ve been closely following the evolution of their DSP from DoubleClick Bid Manager (DBM) to DV360, and are impressed by the platform they’ve been able to create with features including direct integration, tagless trafficking, ad serving, and more. Let’s take a deeper look at some of the advanced capabilities of DV360.

Linking is simplified with powerful native integrations with Google Marketing Platform (GMP)’s full stack of adtech and other Google tech. Measurement, attribution, sharing of information and other associated operations are now just a few button clicks away:

- Google Analytics 360 direct integration

- Tag management is handled via a direct integration with Google Tag Manager

- Ad serving, tagless trafficking, measurement & attribution, and audience building are handled via a direct integration with GMP’s Campaign Manager ad server

- App measurement via a Firebase integration

- Direct YouTube (TrueView) integration

- Third-party verification vendor integration

- Third-party data provider integration

Even without an ad server linked, DV360 Floodlight tags provide an accurate means of measurement and tracking to assess the effectiveness of ad buys. Floodlights can be used to track on-site actions, build first-party audience segments, and collect information provided by site visitors.

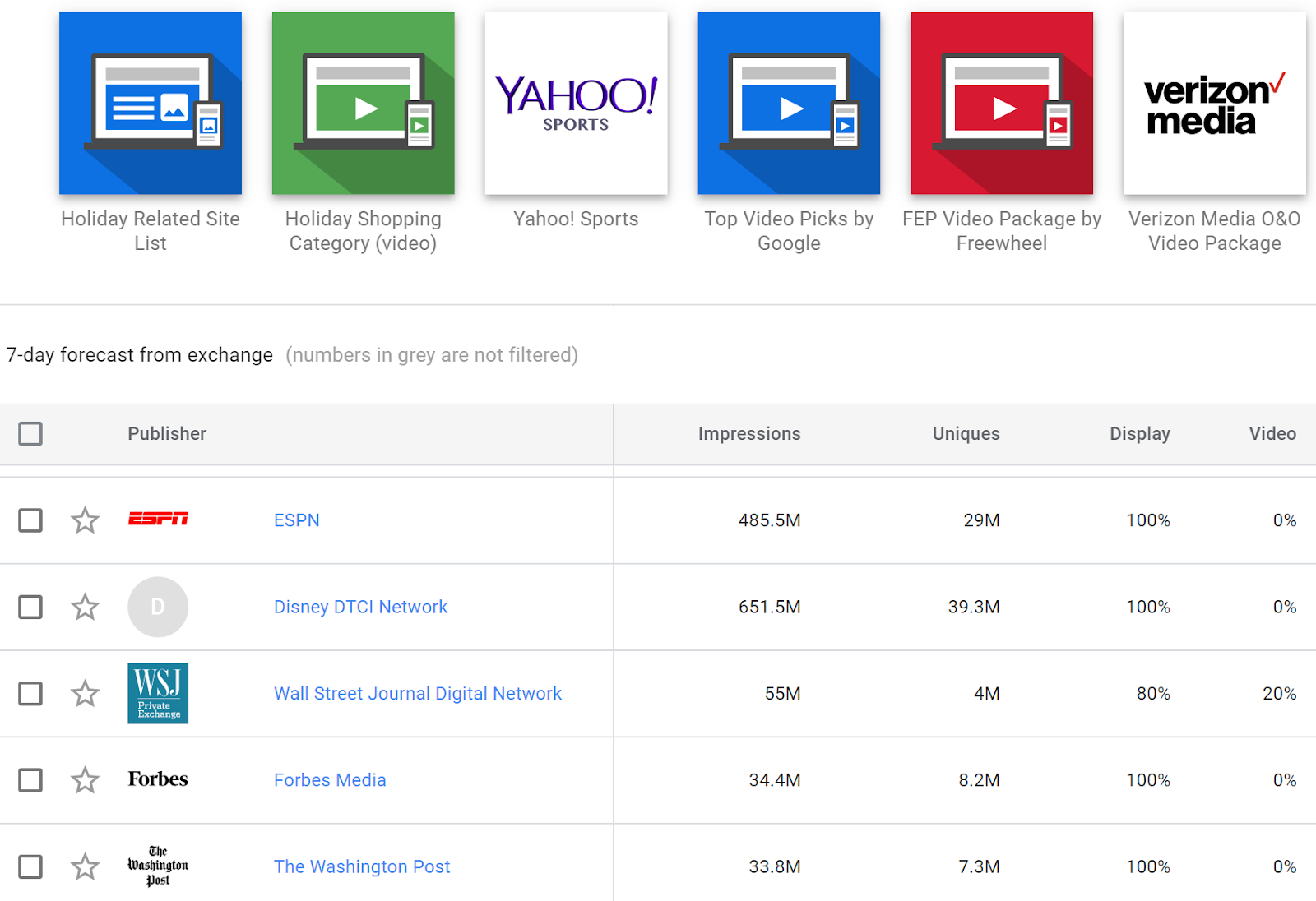

In addition to technology integration, DV360 complements impression-by-impression programmatic buying on the open exchanges with a robust premium inventory marketplace for striking guaranteed deals on high visibility, high impact inventory across some of the most visited sites on the web.

DV360’s Marketplace is GMP’s solution for searching, negotiating, and executing one-to-one direct reservation deals, all from one platform. Marketplace centralizes traditional reservation buying allowing for consolidated buying, trafficking, reporting, and billing.

DV360’s premium inventory Marketplace

Going Forward

Internet media buying has substantially evolved since the mid-‘90s. With the power of DSPs, we can now purchase highly targeted digital ad space efficiently and at a scale. The traditional inefficiencies are now a thing of the past as we can buy ad space across hundreds of thousands of individuals publishers through aggregated inventory in a single repository.

DSPs such as DV360 bring a huge amount of transparency, control, and efficiency to advertisers. Offering direct integration, ad serving, tagless trafficking, measurement and attribution, app measurement via Firebase, and more — DV360 is definitely worth considering as your DSP option.

For those wanting to learn more, we offer several public training courses geared towards ad buying or check out our guide on graduating into a DSP.